Latrobe has agreed to increase its real estate transfer tax and the annual fee it charges for some mechanical devices as city officials continue to fine-tune the proposed $7.4 million 2025 budget.

Council members this week unanimously backed City Manager Terry Carcella’s proposal to double the realty transfer tax to 1%.

He has estimated the hike could bring in an extra $75,000 annually, for a total of about $150,000. That would equal the revenue from 2.7 mills of property tax.

Additional revenue will be needed as the city looks to add staff to help oversee finances and to tackle code enforcement issues while gearing up with staffing and equipment for the city’s plan to take over garbage collection in-house in 2026, Carcella said.

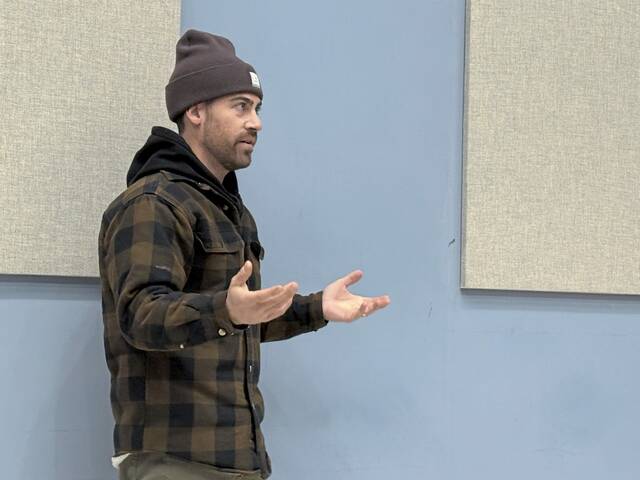

Council approved the transfer tax increase despite concerns voiced by Justin Capouellez, government affairs director for the Realtors Association of Westmoreland, Indiana and the Mon Valley.

Capouellez expressed disappointment with council’s vote. He said the transfer tax hike will add to closing costs of a property purchase and could put Latrobe at a disadvantage when competing with other communities to attract new homeowners.

“There’s unintentional consequences with raising the tax,” he said.

Since payment of the tax typically is shared between the buyer and seller of a property, he said, increasing it would place an added burden on first-time homebuyers and on senior citizens who are looking to sell their home and downsize.

“There’s a lot of money you’ve got to put forth to purchase that first home,” Capouellez said. He indicated the higher transfer tax “is a little bit extra pain they have to feel in order to get over the finish line to be a first-time home buyer.”

Councilman Jim Kelley suggested doubling the transfer tax might add $500 to the cost of buying a typical home in the city.

“If somebody likes a house, that $500 is not going to mean a lot,” Kelley said.

Mayor Eric Bartels agreed the transfer tax hike should not have a major impact on homebuyers. He argued it’s a better way of increasing revenue than raising the city’s 21.5-mill real estate tax.

As the transfer tax increase won council approval, Capouellez proposed the city consider an alternate measure: a rebate for affected first-time home buyers — possibly through a deduction from their city property tax bill.

Councilman Ralph Jenko agreed a rebate might be a future option to consider.

Raising the transfer tax rate and the mechanical device fee were among recommendations in a strategic management plan recently completed for Latrobe by consultant Grass Root Solutions.

Under the schedule of fees council approved for 2025, the city now will charge a $400 annual fee for gaming machines that provide payouts to players. Other mechanical devices — including jukeboxes, bowling machines and pool tables — will continue to be assessed at a rate of $100 per year.

Carcella suggested the change to the mechanical device fee could increase resulting annual revenue to about $35,000.

“We had less than half of that before,” he said.

Council is expected to finalize the 2025 budget at a special Dec. 23 meeting.